Running a restaurant isn’t just about serving great food. It’s about keeping your people happy, organized, and paid on time. Yet payroll is one of the biggest headaches in the hospitality business. Between hourly staff, tip reporting, multiple pay rates, and last-minute schedule changes, it’s easy for things to get messy.

That’s why payroll software for restaurants has become one of the most helpful tools for owners and operators who want to save time and stay compliant. When used right, it helps you pay your team faster, track labor costs better, and avoid costly errors that can drain your profits.

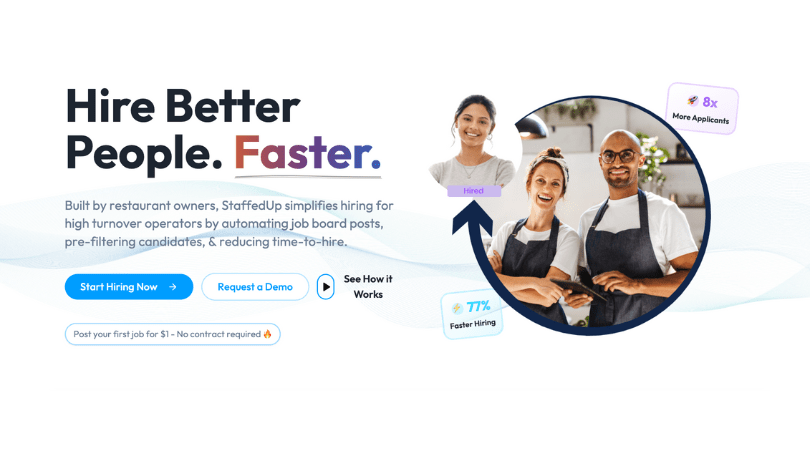

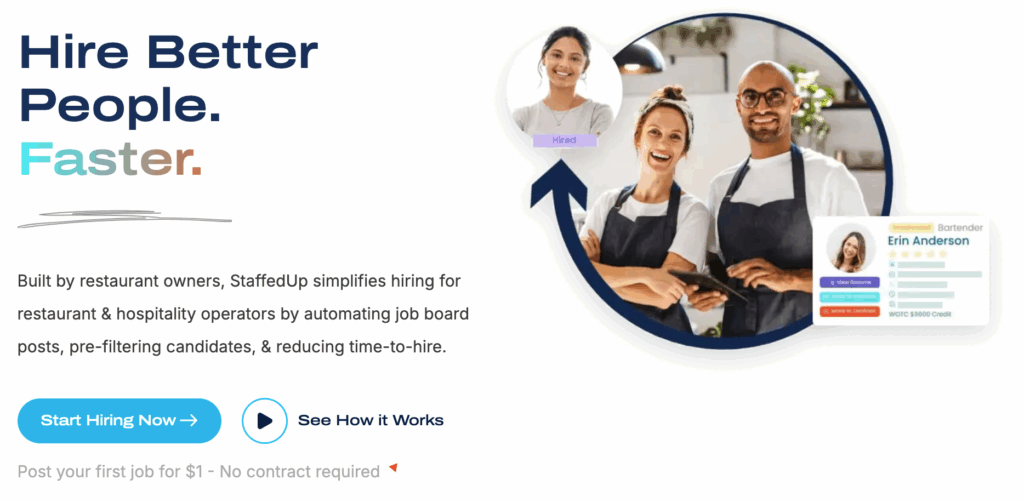

Let’s look at what restaurant payroll software actually does, what to look for, and how using the right system—like StaffedUp’s hiring and team management tools—can help your business run smoother than ever.

Why Payroll Is So Hard for Restaurants

Payroll in restaurants isn’t like payroll in other industries. Your team might include hourly workers, salaried managers, tipped employees, and part-time staff who bounce between shifts. Labor laws also vary by state, which adds another layer of confusion.

Here are the main challenges restaurant owners face when handling payroll:

- High turnover: You’re hiring and onboarding new staff constantly. Keeping payroll updated every week can eat up valuable time.

- Tipped income: You must track reported tips accurately to stay compliant with tax laws.

- Shift changes: Employees swap shifts, work overtime, and clock in early or late, which can throw off pay calculations.

- Compliance: Restaurants must follow federal, state, and local labor rules, including minimum wage and overtime laws.

- Multiple locations: If you operate more than one unit, each might have different tax rates and local regulations.

These issues make it easy for payroll mistakes to pile up—and those mistakes cost money. According to the IRS, about 33% of small businesses get fined yearly for payroll errors.

What Payroll Software for Restaurants Does

Good payroll software helps take the stress out of managing wages, tips, and compliance. It replaces manual tracking or spreadsheets with one simple system that handles everything from pay runs to tax filing.

Here’s what a reliable restaurant payroll system can help you do:

- Automate wage calculations: No more manual math or rounding errors.

- Track tips accurately: Keep records for both direct and pooled tips, and make reporting easy for staff.

- Sync with time clocks: Automatically import hours worked from your scheduling system.

- Handle multiple pay rates: Pay line cooks, servers, and managers correctly, even if they work different jobs or shifts.

- File taxes: Generate and file payroll taxes on time to avoid penalties.

- Send direct deposits: Pay your team quickly and securely every payday.

- Store records: Keep W-2s, pay stubs, and tax forms organized and accessible.

The best payroll tools go even further by connecting hiring, scheduling, and onboarding all in one system. That’s where StaffedUp helps restaurant operators stay on top of both people and payroll.

Signs You Need Payroll Software in Your Restaurant

If you’re still managing payroll with spreadsheets or manual time cards, it’s probably costing you more time and money than you realize.

Here are clear signs it’s time to upgrade:

- You spend hours every week doing payroll.

- You make frequent math or tax errors.

- You can’t easily track tips or overtime.

- You struggle with compliance across locations.

- You have constant turnover and onboarding delays.

- Your staff complains about late or incorrect paychecks.

Payroll shouldn’t be stressful. It should just work. The right software turns payroll into a simple process that runs in the background while you focus on running your restaurant.

Want to take control of your hiring and payroll process? Try StaffedUp today — built for restaurant operators who need to move fast and stay organized.

Key Features to Look for in Restaurant Payroll Software

Not all payroll systems are built for the hospitality industry. Before choosing one, make sure it includes these restaurant-specific features:

1. Integration with Scheduling and Time Tracking

Your payroll system should pull employee hours automatically from your scheduling app. This prevents data entry errors and saves hours each week.

2. Tip Management

The system should support direct, pooled, and declared tips and make reporting simple for both employees and management.

3. Multi-Location Support

If you manage more than one restaurant, look for a tool that can manage payroll across all sites under one dashboard.

4. Tax Filing and Compliance

Good payroll software automatically calculates and files federal, state, and local taxes. It should also keep up with changing labor laws.

5. Mobile Access

Restaurant managers are always on the go. Mobile-friendly payroll makes it easy to approve time sheets, view reports, or fix errors from anywhere.

6. Easy Onboarding

Integrating hiring and payroll systems means employee info carries over automatically—no duplicate entry or paperwork.

7. Custom Reports

A strong payroll system gives you insights into labor cost percentage, overtime trends, and turnover impact—so you can make smart business decisions.

Benefits of Using Payroll Software in Your Restaurant

Switching from manual payroll to an automated system doesn’t just save time—it improves accuracy, compliance, and staff satisfaction.

| Benefit | How It Helps |

| Saves time | Automates hours, pay, and tax filing |

| Reduces errors | Removes manual calculations and spreadsheets |

| Keeps you compliant | Follows updated labor and wage laws |

| Improves morale | Employees get paid correctly and on time |

| Simplifies multi-location payroll | Handles taxes and staff data across stores |

| Gives insights | Reports help you manage costs better |

When payroll is accurate and fast, employees trust you more—and trust reduces turnover. The smoother your payroll process, the happier your team.

Simplify your restaurant’s hiring and payroll today with StaffedUp’s all-in-one platform. Fast, accurate, and built for hospitality.

Case Study: How StaffedUp Helped a Multi-Unit Operator Fix Payroll Chaos

Locations: 6 restaurants across the Midwest

Before switching to StaffedUp, this group struggled to manage hundreds of hourly employees across multiple locations. Payroll took days to process, tips were inconsistently reported, and onboarding delays made new hires start late.

Challenges:

- Disconnected systems for hiring, scheduling, and payroll

- Managers spending up to 10 hours weekly reconciling hours

- Missed payroll deadlines and frequent errors

The StaffedUp Solution:

By connecting hiring, onboarding, and payroll tools into one simple dashboard, this group fixed their entire back-office process. StaffedUp helped them:

- Import hours directly from scheduling systems

- Sync employee data automatically from new hire forms

- Automate tip reporting and tax filings

- Give managers real-time payroll visibility

Results:

- Payroll processing time dropped by 65%

- Overpayment errors cut by 90%

- New hires onboarded 2 days faster on average

This group no longer scrambles to meet payday deadlines. StaffedUp gave them peace of mind—and time back to focus on the guest experience.

“Before StaffedUp, payroll was a weekly nightmare. Now, everything connects—from hiring to the first paycheck. It’s one less thing to worry about.”

— HR Director

How to Choose the Right Payroll Software for Your Restaurant

When picking a payroll system, start with what matters most for your team and business model. Here’s a quick guide:

- Define your needs: List how many employees you have, your pay types, and what integrations you use.

- Check for compliance tools: The system should handle taxes and wage laws automatically.

- Test user experience: Make sure it’s simple enough for managers to learn fast.

- Ask about support: Payroll issues can’t wait—choose software with reliable customer service.

- Look for integration: The more your hiring, scheduling, and payroll tools talk to each other, the better.

The Future of Payroll in Restaurants

Payroll software is moving toward full automation. AI and automation now track time, tips, and taxes without manual input. Cloud-based systems make it easy for multi-unit operators to pay their teams anywhere, anytime.

Soon, payroll will connect directly to recruiting, scheduling, and performance tools. That means restaurant owners will have a full picture of labor—from hiring to pay—all inside one system.

And that’s exactly where StaffedUp is leading. By connecting hiring + team management + payroll tools, operators can finally control their workforce with one platform built for hospitality.

Final Thoughts: Stop Losing Time to Payroll Chaos

Payroll doesn’t have to drain your time or your patience. The right software helps restaurants handle hiring, scheduling, and pay—all in one simple flow.

When you use a tool made for restaurants, you gain back hours, reduce errors, and keep your team happy. StaffedUp was built with that in mind—to make hiring, onboarding, and paying your team easier than ever.

Ready to make payroll simple? Get started with StaffedUp today. Post your first job for $1 and see how smooth your next pay cycle can be.