Hiring in the restaurant industry has always been a balancing act — finding reliable, motivated staff while managing tight budgets, seasonal swings, and constant turnover. But in 2025, that challenge has grown even more complex. Between staffing shortages and rising labor costs, operators are searching for smarter ways to attract, screen, and hire top talent.

That’s where a restaurant-focused applicant tracking system (ATS) comes in. Using the best applicant tracking system for restaurants can simplify every stage of hiring — from job posting to onboarding — helping you build stronger teams faster.

This guide explains everything you need to know about how restaurant hiring software works, which features matter most, and how the right system can transform the way you hire.

What Is an Applicant Tracking System?

An applicant tracking system (ATS) is software that helps businesses manage their hiring process in one place. Instead of juggling emails, spreadsheets, and stacks of paper applications, an ATS automatically collects and organizes candidate information as it comes in.

For restaurants, this is especially valuable. High-volume hiring means managers need a simple way to sort through dozens — sometimes hundreds — of applicants for roles like servers, cooks, and bartenders. A restaurant ATS helps by:

- Collecting all applications in a single dashboard

- Sorting candidates based on job role and location

- Allowing quick resume review and rating

- Keeping notes and communication organized

Most general hiring systems weren’t designed for restaurant teams. That’s why the best restaurant hiring software focuses on speed, simplicity, and flexibility for multi-unit operations.

Why Restaurants Need an ATS in 2025

Hiring challenges in hospitality have reached new levels. A recent report from the National Restaurant Association showed that 62% of restaurant operators say staffing is their biggest struggle. Turnover rates hover around 75–80% annually for hourly roles.

That means managers spend a huge amount of time hiring — often without the tools to do it efficiently.

Without a restaurant-specific ATS, hiring can feel like a never-ending loop:

- Posting jobs manually on multiple platforms

- Sorting resumes by hand

- Losing track of promising candidates

- Missing interview follow-ups

An ATS for restaurants helps break this cycle by automating key steps and keeping everything in one place. When your system handles most of the heavy lifting, you can focus on interviewing, training, and retaining your best team members.

Pro Tip: The best applicant tracking systems don’t replace people — they make hiring teams more productive. With automation, you get back time to focus on creating a great workplace.

The Benefits of Using a Restaurant-Focused ATS

A strong applicant tracking system offers more than just organization. It can directly improve your bottom line, speed up hiring, and reduce turnover.

Here are some of the biggest advantages:

1. Faster Resume Screening

Pre-screening tools help you automatically filter candidates based on experience, availability, or required certifications. This saves managers hours each week.

2. Efficient Candidate Tracking

Every applicant is stored in one digital profile — complete with resume, notes, messages, and interview status. No more lost emails or sticky notes.

3. Better Collaboration

Managers and hiring teams can share feedback and make hiring decisions together in real time. That means fewer delays and miscommunications.

4. Improved Candidate Experience

When communication is consistent and quick, applicants feel respected — even if they don’t get the job. That’s key for your restaurant’s reputation.

5. Time and Cost Savings

Automation reduces time-to-hire by up to 40%, saving money on advertising and training by finding the right person faster.

Case in Point: A multi-location bar group using StaffedUp’s ATS cut their hiring time from three weeks to under ten days — while improving candidate quality.

Key Features to Look for in the Best Restaurant Applicant Tracking System

When comparing ATS tools, focus on systems built with hospitality in mind. Many general business platforms are too complex or not built for the pace of restaurant hiring.

Here are the most important features to look for:

| Feature | Why It Matters |

| Mobile-Friendly Applications | Many restaurant workers apply from their phones. If your job form isn’t mobile-ready, you’ll lose applicants fast. |

| Pre-Screening Questions | Filter applicants with simple qualifying questions to identify top candidates quickly. |

| Social Media Integration | Post to Facebook Jobs, Instagram, and Google with one click to reach a larger pool. |

| Team Access | Let multiple managers review, comment, and move candidates through the process. |

| Automation Tools | Automatically send follow-up emails, reminders, and interview invites. |

| Reporting Dashboard | Track where your best hires come from and which locations need support. |

| WOTC Screening | Identify candidates eligible for tax credits before hiring — improving your ROI. |

A system with these features helps restaurant owners focus on what matters most — finding and keeping great people.

Case Study: How StaffedUp Helped a Regional Restaurant Group Hire Smarter

A regional restaurant group with 10 locations across the Midwest struggled to stay staffed through seasonal swings. Before using StaffedUp, they relied on Facebook posts and paper applications, often losing track of good candidates.

After implementing StaffedUp’s restaurant ATS:

- Applications increased 3x within 30 days

- Average time-to-hire dropped from 18 days to 7 days

- Managers reduced manual hiring tasks by 60%

- Turnover decreased by 25% in the first six months

By connecting all their hiring locations to one centralized platform, their managers could share candidate pools, reuse job templates, and communicate instantly — all within StaffedUp.

“It changed the way we hire completely,” said the group’s HR director. “We finally had visibility into every position and could move faster than ever.”

How an ATS Improves the Candidate Experience

A positive candidate experience isn’t just a nice bonus — it’s a competitive advantage. In hospitality, word spreads fast. If your hiring process feels confusing or slow, applicants simply move on.

An ATS helps by:

- Sending automatic confirmation messages

- Keeping candidates informed on where they stand

- Allowing mobile communication with hiring managers

- Making it simple to reapply for future roles

This professional experience reflects your brand’s values and helps you attract better long-term talent.

When you use a system like StaffedUp, you’re not just organizing your workflow — you’re showing candidates that your restaurant values communication and respect.

The ROI of a Restaurant Applicant Tracking System

Every dollar saved in hiring goes straight back into operations. Let’s break down what an ATS can do financially:

| Metric | Without ATS | With ATS |

| Average Time to Hire | 21 days | 9 days |

| Average Cost per Hire | $1,200 | $600 |

| Turnover Rate | 75% | 55% |

| Manager Hours per Week | 10+ | 3–4 |

| Hiring ROI | Moderate | High |

These savings can quickly add up — especially for multi-unit operators managing dozens of hires each month.

Choosing the Right ATS for Your Restaurant

When shopping for the best applicant tracking system for restaurants, keep these questions in mind:

- Is it built specifically for hospitality or general business use?

- Does it integrate with your scheduling and payroll software?

- Can multiple managers access the same system easily?

- Is it simple enough for busy restaurant owners to use daily?

- Does it support your branding with custom career pages?

If you’re answering “no” to any of these, it’s time to consider a more restaurant-focused system.

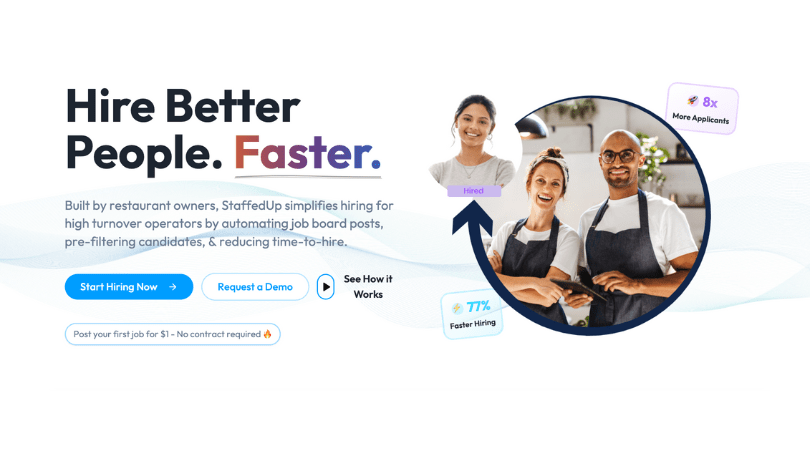

StaffedUp was built from the ground up for restaurant hiring — with features like branded job pages, social recruiting tools, and applicant tracking made simple. It also connects smoothly with leading scheduling and payroll tools, so you can manage your workforce more efficiently.

Conclusion

Hiring for restaurants has changed. The old manual way no longer keeps up with the speed of the industry. To hire faster, smarter, and more efficiently in 2025, you need the best applicant tracking system for restaurants — one built for the fast-moving world of hospitality.

With a restaurant-specific ATS like StaffedUp, you can:

- Save hours each week on manual hiring tasks

- Keep your team organized and in sync

- Create a better candidate experience

- Reduce turnover and hiring costs

If you’re ready to make hiring easier across every location, visit StaffedUp to learn more or schedule a demo today.