Running a profitable restaurant takes more than great food and hospitality — it requires smart financial management, especially when it comes to labor. In fact, labor is one of the largest expenses restaurant owners face, often accounting for 30–40% of total revenue.

That means finding ways to reduce labor costs in a restaurant — without cutting corners or hurting service — is essential for long-term success. But how do you do that effectively?

In this in-depth guide, we’ll break down practical, proven strategies to help you manage labor expenses while keeping your team happy and your guests coming back. Let’s dive in.

Why Labor Costs Matter So Much in Restaurants

Labor costs include wages, payroll taxes, benefits, and sometimes overtime or bonuses. These expenses are necessary investments — after all, your staff creates the guest experience.

But when labor costs climb too high, they can quickly erode profits.

Restaurants often face challenges like:

- Fluctuating guest traffic

- Inefficient scheduling

- High turnover

- Excessive overtime

- Seasonal hiring spikes

Balancing all of these factors requires a mix of strategy, technology, and team engagement. Let’s explore how to do it right.

1. Analyze and Optimize Staffing Levels

One of the most effective ways to reduce labor costs in restaurants is by aligning staffing with demand.

Use Data to Forecast Labor Needs

Review your historical sales data, reservations, and seasonal patterns. This helps identify peak hours, busy seasons, and slower periods.

When you understand these trends, you can schedule strategically — ensuring you’re never overstaffed on a slow Tuesday or understaffed on a Saturday night rush.

Use Smart Scheduling Tools

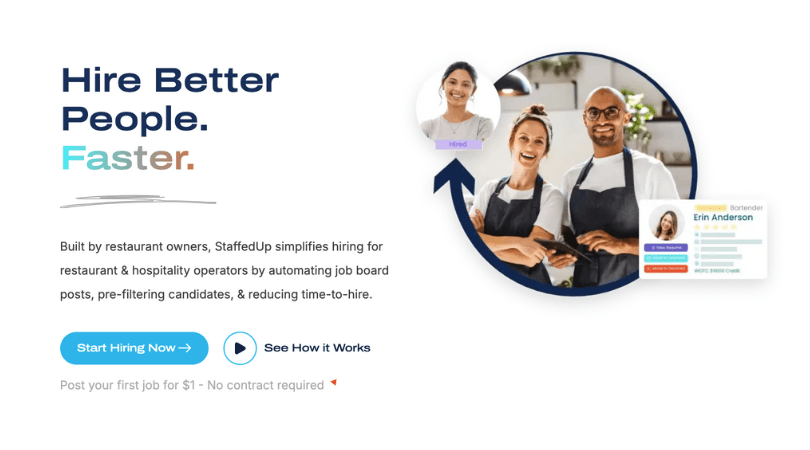

Technology makes this easier. Digital scheduling tools and hiring platforms like StaffedUp help you analyze past performance and automate staffing adjustments.

With the right data, you can build efficient schedules that keep labor percentages in check — and still maintain excellent service.

2. Cross-Train Your Team

Cross-training is one of the simplest, most cost-effective ways to improve productivity.

By training your team members to handle multiple roles, you create flexibility and reduce the need for additional hires. This can be useful if pulling team members to other locations as well.

Examples of Cross-Training in Restaurants

- Servers can assist with hosting or bussing during slow periods.

- Line cooks can support prep work or expo when needed.

- Bartenders can help manage takeout or online orders.

Not only does cross-training reduce idle time, it also boosts morale — employees who learn new skills feel more valued and invested in the business.

Pro Tip: Highlight training opportunities in your job descriptions when hiring through StaffedUp — candidates are more likely to apply when they see room for growth.

3. Embrace Restaurant Technology

Automation (or AI) and digital tools are changing the hospitality industry — and they can dramatically help you reduce labor costs in your restaurant.

Where to Implement Technology

- Scheduling & Payroll: Tools that integrate POS data with time tracking help forecast shifts more accurately.

- Inventory & Ordering: Automating inventory management reduces the manual hours your team spends counting and ordering.

- Hiring & Onboarding: Platforms like StaffedUp streamline posting jobs, screening applicants, and onboarding — saving hours of admin time each week. Instead of manually building onboarding packets, let a hiring system take care of it.

- Self-Service Options: Tableside ordering or QR code menus can reduce reliance on front-of-house labor during busy periods.

Technology doesn’t replace great people — it allows your staff to focus on guest experience instead of repetitive tasks.

4. Monitor and Minimize Overtime

Unchecked overtime is one of the biggest profit leaks in restaurant operations.

Even a few hours per week of unnecessary overtime can add up fast. The solution isn’t cutting hours — it’s managing them smarter.

How to Control Overtime

- Set clear weekly hour limits for each role.

- Use scheduling software that flags overtime risks before they happen.

- Encourage shift swapping within policy guidelines.

- Ensure managers approve any overtime in advance.

By proactively managing scheduling and approvals, you’ll keep overtime under control and protect your labor budget.

5. Improve Employee Retention

Turnover costs restaurants thousands per employee when you consider lost productivity, recruitment, and training.

Reducing turnover is one of the most powerful ways to cut long-term labor costs. Employers don’t understand the true cost of hiring an employee. The hard costs and time can be draining on management when constantly hiring.

Retention Strategies That Work

- Offer clear growth paths and cross-training opportunities.

- Recognize great performance regularly.

- Maintain consistent, transparent communication between management and staff.

- Keep schedules predictable — avoid last-minute changes when possible.

When employees feel valued, they’re more productive, reliable, and loyal — all of which reduce your total labor costs.

Need help hiring dependable, long-term team members? Post your open positions on StaffedUp — the hospitality hiring platform that connects restaurants with ready-to-work candidates fast.

6. Outsource Non-Core Functions

Certain operational tasks can be handled more efficiently by third-party vendors.

Outsourcing can help lower costs by converting fixed labor expenses into variable costs that flex with your business volume.

Common Areas to Outsource

- Laundry and linen service

- Deep cleaning or janitorial tasks

- Equipment maintenance

- Accounting or payroll processing

By outsourcing time-consuming, non-core functions, your in-house team can stay focused on what matters most — creating great guest experiences.

7. Track Key Labor Metrics

You can’t reduce labor costs in your restaurant if you’re not measuring them.

Tracking labor metrics helps you spot inefficiencies early and adjust operations before they impact your profits.

Metrics to Monitor Regularly

- Labor Cost Percentage: Total labor cost ÷ total sales (aim for 25–35%)

- Sales per Labor Hour: Revenue divided by total labor hours worked

- Overtime Hours: Watch for trends or recurring scheduling issues

- Employee Turnover Rate: High turnover = high hidden labor costs

Review these metrics weekly or monthly with your management team. Use them to guide scheduling, hiring, and training decisions.

8. Build an Agile Hiring Process

Hiring the right people, faster, makes all the difference in controlling labor costs.

Slow hiring can lead to overworked teams, increased overtime, and poor service — all of which cost money.

Make Hiring More Efficient

- Use a hospitality-specific platform like StaffedUp to reach qualified applicants.

- Automate applicant screening and communication.

- Keep your job descriptions concise and transparent.

- Build a talent pool so you can hire quickly when turnover happens.

A modern hiring system helps you stay staffed appropriately and avoid expensive short-term fixes like temp workers or agency fees. Make sure you understand what roles are needed and how many staff members you need for each role.

9. Enhance Productivity During Shifts

Productivity isn’t about rushing — it’s about using every hour wisely.

A restaurant that improves daily efficiency can reduce labor hours without cutting service quality.

Ways to Boost Productivity

- Review prep lists and workflows to eliminate wasted motion.

- Organize stations logically for faster service.

- Communicate clearly with staff before and during each shift.

- Encourage teamwork and mutual accountability.

Small process improvements across multiple shifts add up to major labor savings over time. A cohesive team allows for you to worry about other aspects of the company. You’re always needed some where – leave the hiring to a trusted partner who knows this industry inside and out.

10. Create a Culture of Efficiency and Ownership

When your team understands that labor costs directly impact the restaurant’s success (and their job security), they naturally become more mindful about efficiency.

Encourage your staff to share ideas on saving time, improving processes, and reducing waste. Recognize and reward those who take initiative.

A culture that values efficiency doesn’t just save money — it strengthens teamwork and guest satisfaction.

Featured Snippet: 5 Ways to Reduce Labor Costs in a Restaurant

If you want a quick summary, here are five top strategies that work for most restaurants:

- Analyze staffing levels and optimize scheduling

- Cross-train employees for flexibility

- Use restaurant technology to automate tasks

- Control overtime and improve shift planning

- Retain staff through engagement and recognition

Each of these strategies can reduce labor costs while improving service consistency.

Case Study: How One Restaurant Cut Labor Costs by 15%

A restaurant group with over 100 locations used StaffedUp to revamp its hiring and scheduling process.

Within 90 days:

- Turnover dropped by 22%

- Average labor cost percentage decreased from 34% to 29%

- Time-to-hire improved by 50%

By combining technology, cross-training, and data-driven scheduling, they maintained quality service — even while cutting costs.

This example shows what’s possible when you take a holistic, modern approach to labor management.

Conclusion: Smarter Staffing = Stronger Profits

Learning how to reduce labor costs in a restaurant doesn’t mean sacrificing quality or overworking your team. It means running smarter, not harder.

By optimizing staffing levels, leveraging technology, improving retention, and monitoring metrics consistently, you can create a leaner, more efficient operation that thrives — even in challenging market conditions.

And when it’s time to hire, make it simple.

Post your open positions on StaffedUp — the platform designed specifically for restaurants and hospitality employers. You’ll reach active job seekers fast, streamline your hiring, and keep your labor costs right where they should be: efficient and sustainable.